TCP Trigger (Lesson 2) - Basics

Before you start please download and install latest version of WinTrend software.

When opening the software for the first time.

1. Check if all charts included with the desktop have corresponding symbols in your symbols directory.

2. Check if symbols required to display the desktop have at list one data feed assigned.

3. Login.

For the limited period beta version will have the access to the TCP triggers.

This tool is provided for educational purposes only. Take your time and watch the tool.

Try paper-trading it.

Introduction

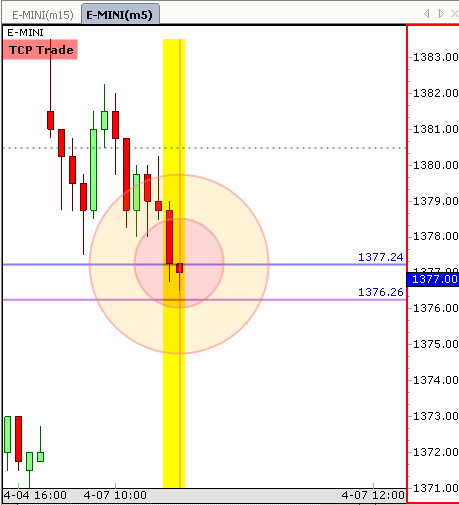

In this introduction I will focus on the easiest yet most reliable trade provided by the TCP Trigger.

The rule is simple: trade one the first trade of the day identified by the tool. All other trades require

in depth knowledge and in depth understanding of the tool. Look at the chart1 below this is how TCP signal

may look like. The ratio between inner and outer circle is you risk/ reward ratio. With the TCP Trigger you

always trade even number of contracts. Half of the profit is taken when price reach the inner circle and

second half of the profit is taken when the price is at or above of the outer circle.

You stop loss is always at outer radius the inner circle.

On the example below trade should be entered at the intersection of vertical red line and horizontal blue line.

That is all there is to it.

Example 1: Trade signal:

Pic. 1

Pic. 1

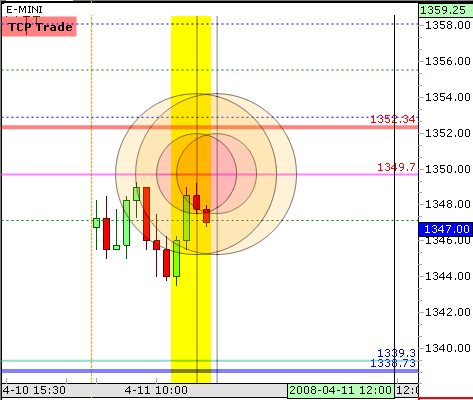

Example 2: End of trade signal (see Pic. 1):

Pic. 2

Pic. 2

Example 3: Trade signal:

Pic. 3

Pic. 3

Trading

There is always at list two active targets, one to upside and one to the downside.

Targets are not support/resistance. Market does not have to stop at the target but when it does 75%

of time it is on one of the targets.

Most reliable trades happen in the morning. In fact 75% of all highs and lows are set in the first

two hours of trading. Type 1 TCP trade setup always happens during first two market hours.

Start with Type 1 TCP trade, paper trade enough to become familiar with the different aspects of the trade.

Type 1 TCP trade

1. Price must be at the active target plus minus one tick.

2. Price must be in the trading window. (One 5 min bar before, on time or one 5min bar after actual time target)

Targets are just what there are, no more and no less are. While targets often prove to be points for

support/resistance conformation from higher time frames is required.

Type 2 TCP trade

For the type 2 trade you will need conformation from ether weekly or monthly active targets.

Recomendations (for beginners)

We can have two time events with in 10 to 15 minutes and the targets will overlap.

If the first trade is successful do not take the second trade.

Do not take second trade if the direction of the second trade is opposite to the direction of

the first trade.

If you are beginner avoid trading more than once a day.

If you are beginner Avoid trading after 11:30 NY time.

Example 4: Trade signal (two time events):

Pic. 5

Pic. 5

Example 5: Trade signal: