Using Spreads : A spread involving two commodities

A commodity-product spread involves the

purchase of a given commodity and a subsequent sale of products derived from commodities of the same type.

Generally, these two transactions take place simultaneously. However, if there is a relatively small

amount of time between the execution of the two transactions, the strategy is still considered to be a

commodity-product spread.

It is also possible for a commodity-product spread to be conducted in reverse sequence.

That is, the purchase of commodities may take place after the sale of products made with the same type

of commodity. In both cases, there is generally no more than a thirty-day window in between the two

transactions that compose the spread.

Under the broad classification of a commodity-product spread are a number of specialized spreads.

One common transaction of this nature is known as the crack spread.

Essentially, a crack spread is a commodity-product spread that has to do with commodities such as

crude oil. An example of a crack spread

would be the purchase of crude oil coupled with the sale of such products as

heating oil or gasoline.

Another type of commodity-product spread is the crush spread.

Crush spreads usually have to do with foodstuffs, such as corn or soybeans.

Like all versions of the commodity-product spread, an investor may choose to purchase

soybean futures and then sell any futures

associated with soybean oil, meat substitutes

made with soybeans, or dairy substitute products such as soy.

The purpose of a commodity-product spread is to allow the investor to ride a commodity market that is

currently experiencing an upswing. The purchased component will often be acquired at a good price,

with the component sold earning a return that covers the cost of the acquired commodity futures contract.

By watching the market and continually rolling over investments within the commodities market,

it is possible to earn a substantial return using this strategy. In general, the application of a

commodity-product spread is expected to carry a low risk in comparison to other investments.

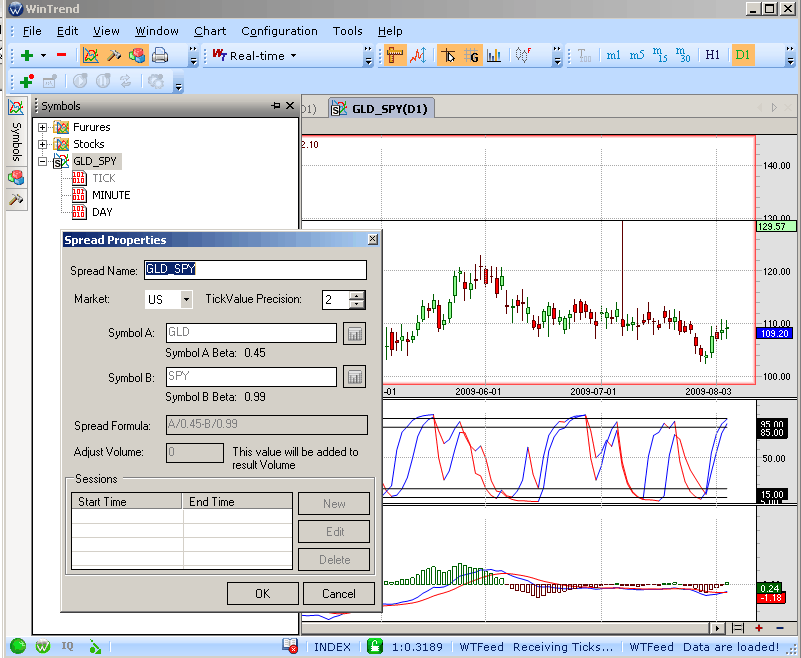

WinTrend allows you can create wide variety of spreads between any two symbols available in the data

portfolio. For example Crack spread,

between crude oil and gasoline ETF’s is USO/beta – UGA/beta

After the spread or the synthetic security has been created we can apply any study or tool.